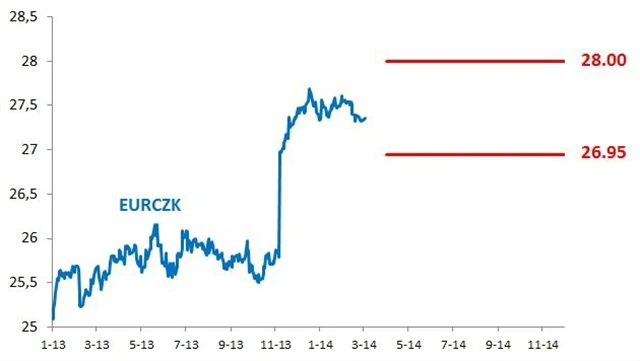

Do you see EUR/CZK between 27 and 28? Think about Bonus KIKO

The CNB continues in promising to keep the koruna above 27 against the euro. CNB’s comments about a further weakening the koruna have disappeared. If you are buying euros and expect the euro-koruna between 27 and 28 this year, think about Bonus KIKO-forward. It will hedge your future rate of purchasing euro at slightly below 27, if the euro-koruna will remain in the range of 27-28.

Central bankers (CNB) are repeating their promise that koruna will not be stronger than 27 against the euro till at least the end of the year. Recent optimistic macro-economic figures, such as GDP in 4Q13, have not shaken their promises. The CNB is unlikely to change its FX intervention policy stance, taking into account not only ongoing macroeconomic picture in the country but also all critics the CNB has been facing since last November. An early abandonment of the floor of 27 against the euro would admit that the decision to launch FX interventions was wrong.

Positive macro-economic figures have made any thoughts about pushing the euro-koruna floor from 27 to 28 or higher less appealing. CNB comments about further weakening of the koruna have disappeared. The koruna market continues to stabilize after large FX intervention (EUR 7.5bn) on the ongoing inflow of euros from the country’s trade surplus. Betting on a significantly weaker koruna does not make much sense without expected support of FX interventions. Because of this, speculative FX bets are currently absent on the koruna market. As a result, the koruna is significantly less reactive than other Emerging Market currencies to global development – from interest rate outlook and Fed policy to geopolitics in Ukraine.

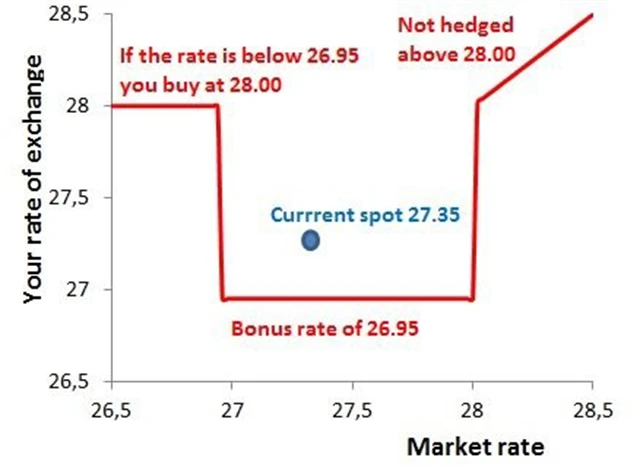

If you are buying euros, expect the CNB to keep its FX policy unchanged and that the koruna will remain range-bound between 27 and 28 this year, we offer to hedge future purchases of euros with Bonus KIKO-forward.

The hedging strategy will enable you to buy euros at bonus rate slightly below 27, i.e. lower rate than plain forward, as long as the koruna remain in the range of 27-2.

The advantage of better than plain forward rate is compensated by two disadvantages:

- You are not hedged, if the koruna weakens above 28 against the euro;

- if the CNB stops intervening and the koruna strengthens below 27, you will buy euros at the rate of 28.

Due to the second feature, we recommend to use the hedging strategy only by the end of the year, not longer, i.e. only for time period when the CNB is highly likely to keep its intervention promise.

Setting the exact bonus EURCZK rate and the range of EURCZK rate, where you buy at bonus rate, depends on how long is hedging period and initial spot rate. See an indicative example of Bonus KIKO hedging at today’s spot rate of 27.35, hedging monthly purchases of the same amount of euros from end-March to end-December.

Bonus KIKO-forward for importers (for period of March-December)

Source: Erste Corporate Banking

Past development of EUR-CZK and Bonus KIKO-forward (for period of March-December)

Source: Erste Corporate Banking, Bloomberg

Aktualita pro rok 2026

Doporučujeme

Aktuality