Do you trust CNB’s intervention policy? We offer KIKO-forward

The CNB promises to keep the EUR/CZK above 27 in the coming months but does not prefer a larger weakness. A stronger koruna can slice off up to 50 hellers from each sold euro, even with the CNB guarding at 27. Using KIKO-forward you will hedge your future sale of euros at the current spot rate of 27.50 and keep possibility to participate in a potential slight weakening of the koruna.

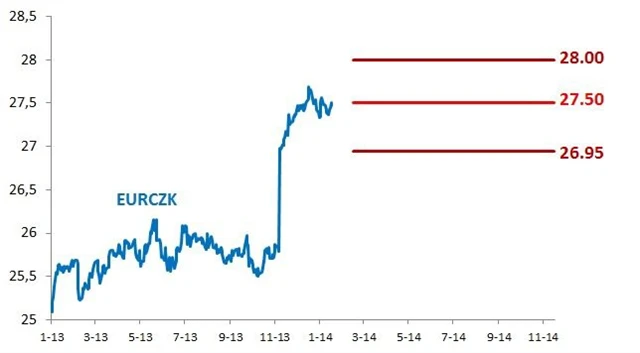

The Czech National Bank (CNB) promises that the euro will not cost less than 27 korunas during the year. The floor of twenty-seven is sufficient, according to several recent comments of CNB Governor Singer. He does not see a reason to drive it weaker. The euro-koruna is currently trading close to 27.50 as the market is in re-balancing process after a large FX intervention in November. There is still surplus of CZK liquidity in the market as the CNB took out EUR 7.5bn in November (equal to roughly two thirds of annual trade surplus). Yet, a larger koruna weakness lacks an impulse of threat of further FX interventions or bad economic development.

Local and European macroeconomic figures indicate that long-lasting downturn has finally ended. The inflow of FX into the country from trade surplus is slowly rebalancing the FX market, dis-balanced after the intervention. If the ongoing recovery of European economy does not fail, the koruna will tend to return to stronger and fundamentally more appropriate levels. To the levels from where the CNB’s intervention kicked it out. Our economists foresee such development in their forecast.

In the coming months, the CNB will stay against a larger koruna rally. Yet, even with the CNB on guard, a slight strengthening of the koruna can still slice off up to 50 hellers from each sold euro from export.

If you believe that the CNB keeps its FX policy in the coming months we offer a hedging strategy KIKO-forward as an alternative to vanilla forward or vanilla put option.

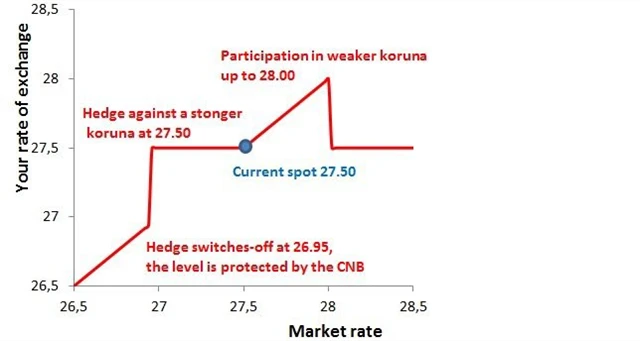

KIKO-forward hedge your future sale of euro revenues at the current spot level of 27.50. At the same time you can participate in a potential koruna weakness. KIKO-forward has two advantages in comparison with its alternatives - vanilla forward and put option:

- Hedged rate is better than the one of forward and put option

- Full and immediate participation in weakening of the koruna above 27.50 up to certain level

The advantages are counter-balanced mainly by the feature that the hedging switches-off when the CNB lets the koruna to find its own appropriate level, takes out intervention floor at 27, and the koruna appreciates below 27. Because of the reason, we propose to build KIKO-forward hedging strategy with knock-out at 27 with max expiration till late-autumn of the year. That means such strategy and levels are appropriate for the time period when it is highly likely that the CNB will keep defending the level of twenty-seven.

The levels where the hedge switches-off or the level of max participation in a weakening depends on hedged horizon. In the example below, there is a KIKO-forward hedging the sale of euro, the same amount at the end of each month, starting in February ending in November (i.e. 10-month period).

KIKO-forward for exporters

Source: Erste Corporate Banking

Past development of EUR/CZK and levels of KIKO-forward hedge

Source: Erste Corporate Banking, Bloomberg